Stress-Test Your Pitch Deck with AI.

The Crucible™ ingests your deck, identifies "brittle assumptions," and predicts investor objections in real-time.

Supports PDF, PPTX. Non-retention mode available.

The Engine in Action

See how the Crucible™ transforms a pitch deck into a forensic analysis, identifying risks most investors miss.

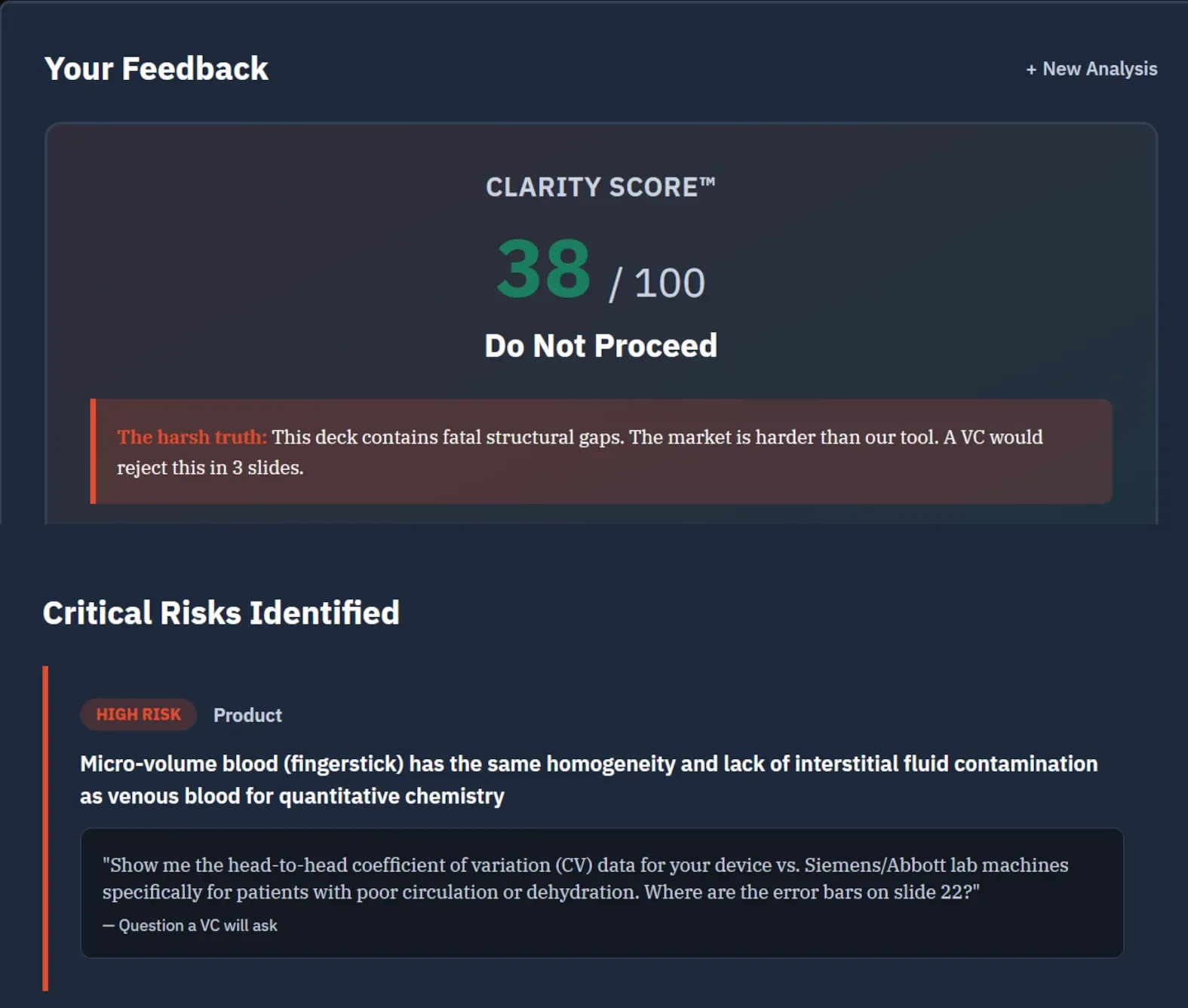

Figure 1: The Crucible Dashboard – Automated Forensic Analysis & Clarity Score™

Every analysis includes a Clarity Score™, identified brittle assumptions, and specific objections investors are likely to raise—before you ever enter the room.

Don't Pitch Blind.

Most founders get rejected without ever knowing why. We fixed that.

The Private Sparring Partner

Get ruthless, confidential feedback without burning a bridge with a real VC. Iterate in the dark so you can win in the light.

The Investor's Playbook

We don't check grammar; we check physics. The engine flags unit economic hallucinations, strategic incoherence, and weak moats.

Defensible Clarity Score™

Walk into the room knowing exactly where your narrative is strong and where it is brittle. Measure your conviction with data.

Workflow vs. Judgment

Most pitch tools track engagement. We audit coherence.

Traditional

DocSend, etc.

askOdin

The Crucible™

Core Job

What does it do?

Tracking clicks

Stress-testing thesis

Output

What do you get?

Metrics

(Time-on-slide)

Forensics

(Logic Gaps)

Identity

How it sees itself

The Messenger

The Partner

Both have value. Only one prevents catastrophic capital misallocation.

Built on AI Judgment Infrastructure™

The Crucible™ is just the interface. The Judgment Graph™ is the Infrastructure.

askOdin is not a wrapper. The Crucible™ is just the interface; the backend is a proprietary AI Judgment Infrastructure trained on 3,000+ outcome-labeled narratives.

We don't check grammar; we audit the physics of the business model. We are digitizing the logic of capital allocation to make judgment scalable and defensible.

The 4-Dimensional Audit:

Logical Consistency

Does Claim A mathematically support Claim B?

Narrative Provenance

Is the market data cited, or is it a hallucination?

Semantic Stability

Penalizing vague "marketing fluff."

Regulatory Physics

Checks against market laws and compliance.

The Engine in Action

Case Study #023: "Project Hydra"

The Pitch

"We have a revolutionary water-tech product and we are selling to Consumers, Businesses, and Governments simultaneously."

Founder's original positioning during Seed fundraise

⚠️ Risk Detected

Strategic Incoherence

Analysis

"Pursuing three conflicting business models with Seed capital guarantees failure. Pick one beachhead."

Outcome

Investor avoided a $2M write-off.

The Crucible identified the fatal flaw before the check was written. This is the difference between pattern recognition and guesswork.

Don't walk into the room blind.

Get your forensic analysis in 3 minutes. Know your brittle assumptions before the investors find them.

Free for all founders. Confidential. No credit card required.

INFORMATION IS COMMODITY. JUDGMENT IS INFRASTRUCTURE. WE ARE BUILDING THE RAILS TO MAKE CAPITAL ALLOCATION AUDITABLE AND DEFENSIBLE.