Join the Alpha Circle.

We are selecting 5 Founding Partners for the Q1 2026 Deployment Cycle.

The Alpha Circle is not a beta test. It is a strategic alliance to co-author the industry standard for Judgment Infrastructure™.

Partners operate in a Dedicated Secure Environment of the Clarity engine. The system is calibrated using your firm's specific "Scar Tissue" and anti-portfolio.

You benefit from our global baseline intelligence, but your proprietary data never trains the public model. Your judgment becomes software. Your data remains sovereign.

01 / Secure Architecture

A dedicated environment with logical separation, ensuring your deal flow never leaks to the public graph.

02 / Thesis Calibration

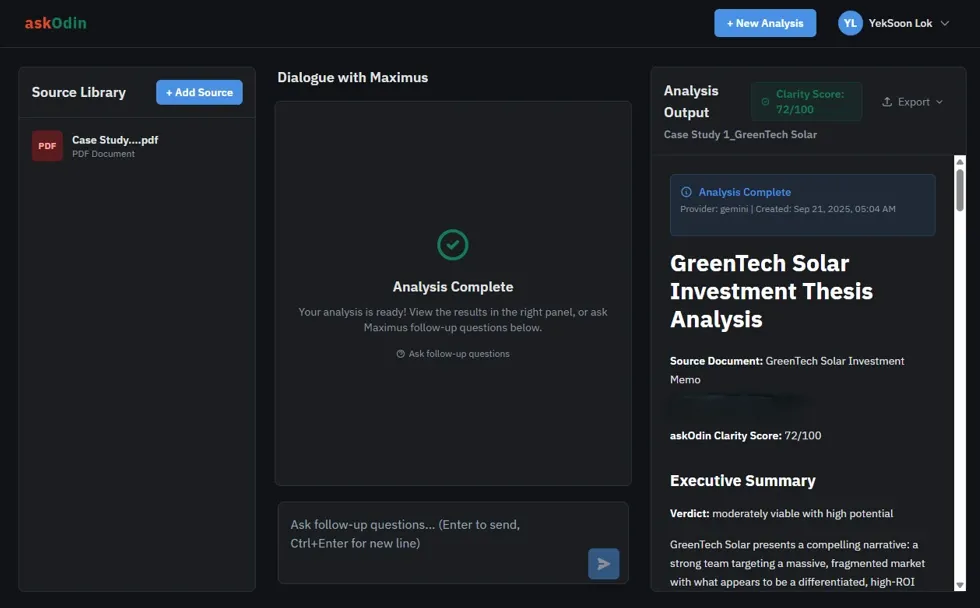

We code your specific investment thesis and "anti-portfolio" logic into the Clarity scoring weights.

03 / Institutional Digitization

Direct access to our engineering team to turn your firm's instinct into executable, scalable code.

Request Briefing (3 Slots Remaining)

Q1 2026 deployment. Invitation-only program.